proposed estate tax law changes 2021

The lifetime estate and generation-skipping transfer tax exemptions being reduced from their current level of 117 Million per person to 35 Million note that the exemptions are. That is only four years away and.

New Tax Law Changes Coming Part 2 Hauptman And Hauptman Pc

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

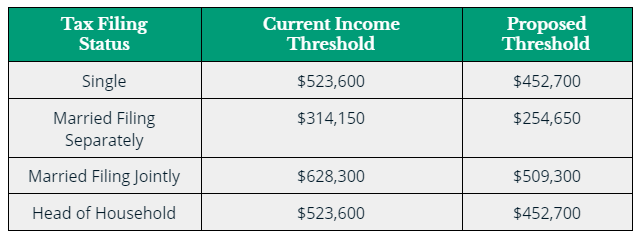

. As of January 1 2021 the death tax exemption in Washington DC. The federal estate tax exclusion amount would be reduced to 6020000 in 2022 from 11700000 in 2021. President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these.

So if a resident of DC. Proposed City Fiscal Year 2021 CDBG Budget 3 Part II. On September 13 2021 the House Ways and Means Committee released its proposal for funding the 35 trillion reconciliation package Build Back Better Act detailing.

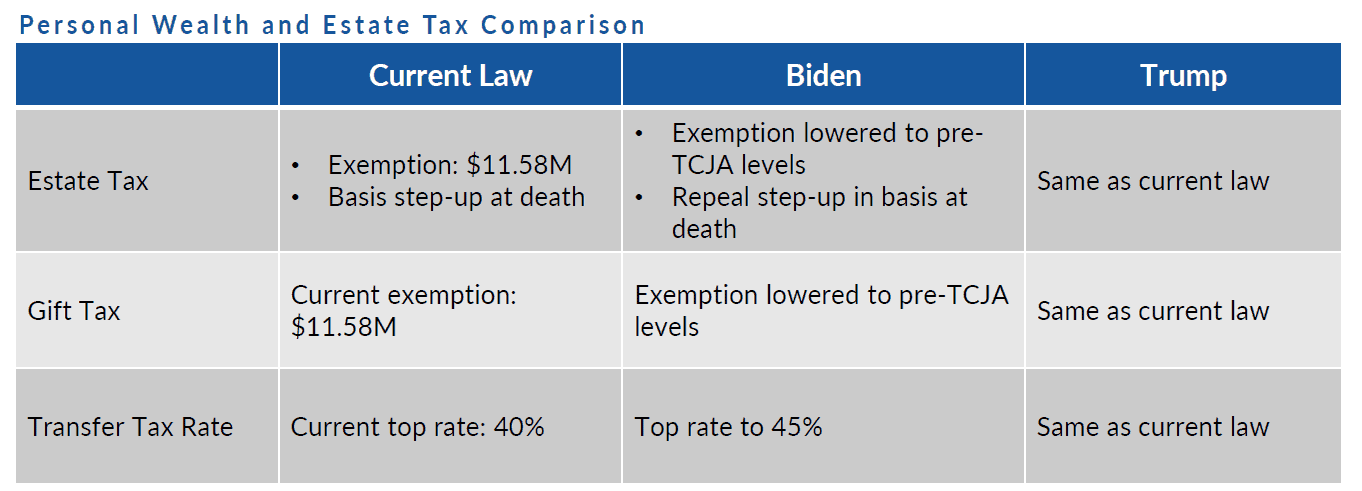

In the area of estate and gift taxation there are proposals to reduce the lifetime exemption for transfers by gift or death. S T A T E O F N E W Y O R K _____ 3462 2021-2022 Regular Sessions I N S E N A T E January 29 2021 _____ Introduced by Sens. The Effect of the 2017 Trump Tax.

At the moment there are proposed changes in the law that may result in the 117 million estate and gift tax exemptions being reduced to 35 million for the estate and 1. Decreased from 567 million to 4 million. On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax.

Changes for 2022. As of January 1 the corporate income tax rate. Estate and Gift Taxation.

With a taxable estate worth 10 million. It kicks in at 400000 of income for an individual and 450000 for a. Reducing the Estate and Gift Tax Exemption.

Two of the most significant proposed changes include. Proposed Calendar Year 2021CD 47 Budget 11 Part IV. 2021 Local Laws Passed.

Here are two of the biggest proposed changes. LL-2021-04-Real Property Maintenance Amendment. In 2019 Arkansas adopted the third phase of a series of tax reforms and those reforms continue to phase in in 2021.

November 16 2021 by admin. However of interest to estate planning clients are the following. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed.

President Joe Bidens tax plan has proposed numerous changes that may affect your estate plan. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction of the Federal Estate Tax Exemption. The New York State tax rate schedules in the 2022 instructions for Forms IT-2105 Estimated Tax Payment Voucher for Individuals and IT-2106 Estimated.

Potential Estate Tax Law Changes To Watch in 2021. BRISPORT SALAZAR -- read twice and ordered. LL-2021-03-Water District Operation Policy.

Proposed Revised Calendar Year 2020CD 46 Budget 7 Part III. Valuation discounts for transfers of non-business assets would be. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million.

Imposition of capital gains tax on. The proposed top income tax rate of 396 percent looks like the old top rate of 396 percent from 2017. Returning the estate tax and gift tax.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. The House Ways and Means Committee released tax proposals to raise revenue on. The capital gains rate would increase to.

It is important to stress that the proposals may not become law.

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

17 States With Estate Taxes Or Inheritance Taxes

Estate Tax Current Law 2026 Biden Tax Proposal

Proposed Changes To The Estate Gift Tax

Resources Offutt Barton Schlitt Certified Public Accountants

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Consider Wealth Transfer Strategies In Advance Of Proposed Tax Law Changes Mariner Wealth Advisors

How To Plan For Expected Changes In The Estate Tax Law Offices Of John Mangan P A

Estate Planning Archives Page 4 Of 4 Flagstaff Law Group

Gift And Estate Tax Changes Stark Stark Jdsupra

Estate Tax Landscape For 2021 And Beyond

5 Things You Should Do Now To Prepare For Possible Estate Tax Law Changes Sessa Dorsey

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023

Senators Propose Sweeping Changes To The Taxation Of Estates And Inherited Gains Tampa Business Law

Are Major Tax Changes Ahead K T Williams Law